Fsa Max For 2025. If you had a flexible spending account (fsa) prior to 2025, you’ve probably heard the phrase “use it. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

What is the new fsa contribution limit in. Meanwhile, the maximum that can be carried forward from 2025 into 2025 in health care accounts will be $640, up from the $610 that can be carried from 2025 into.

Maximum Fsa Contribution 2025 W2023E, 2025 medical fsa contribution limits (including limited and combination fsas) 2025: What is the 2025 maximum fsa contribution?

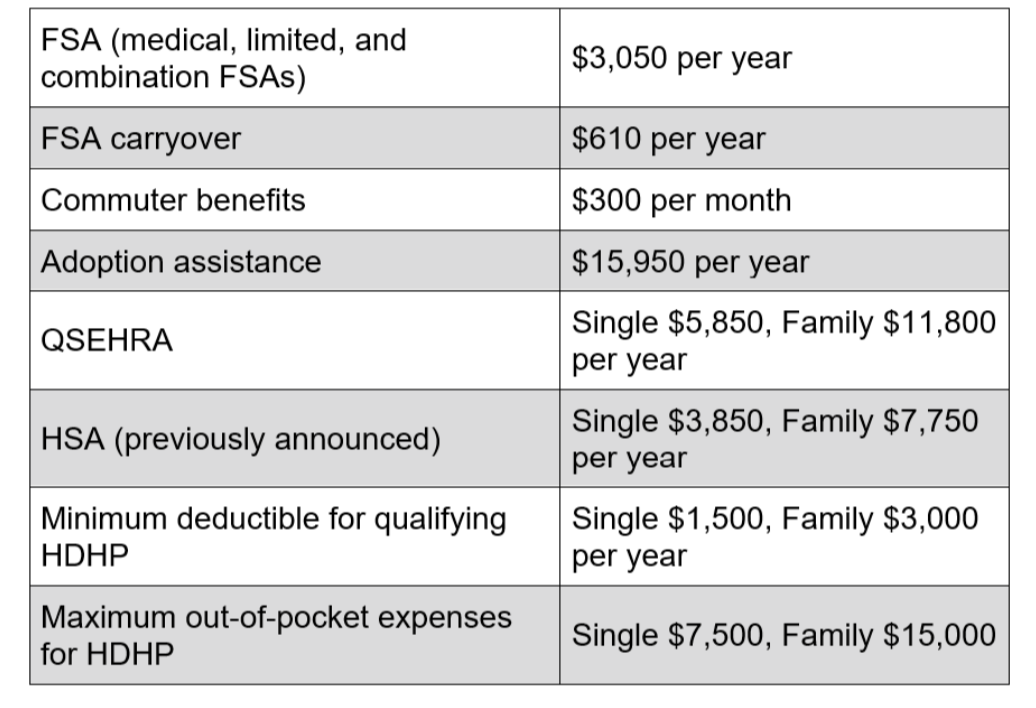

2025 limits for FSA, commuter benefits, and more announced WEX Inc., The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Fsa 2025 Contribution Limits 2025 Calendar, For 2025, you can contribute up to $3,200 to an fsa. What is the new fsa contribution limit in.

Filling Out The 20232024 FAFSA Get Your FSA ID, Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits. For 2025, you can contribute up to $3,200 to an fsa.

2025 Fsa Amounts 2025 Calendar, What is the new fsa contribution limit in. Irs announces 2025 employee benefit plan limits.

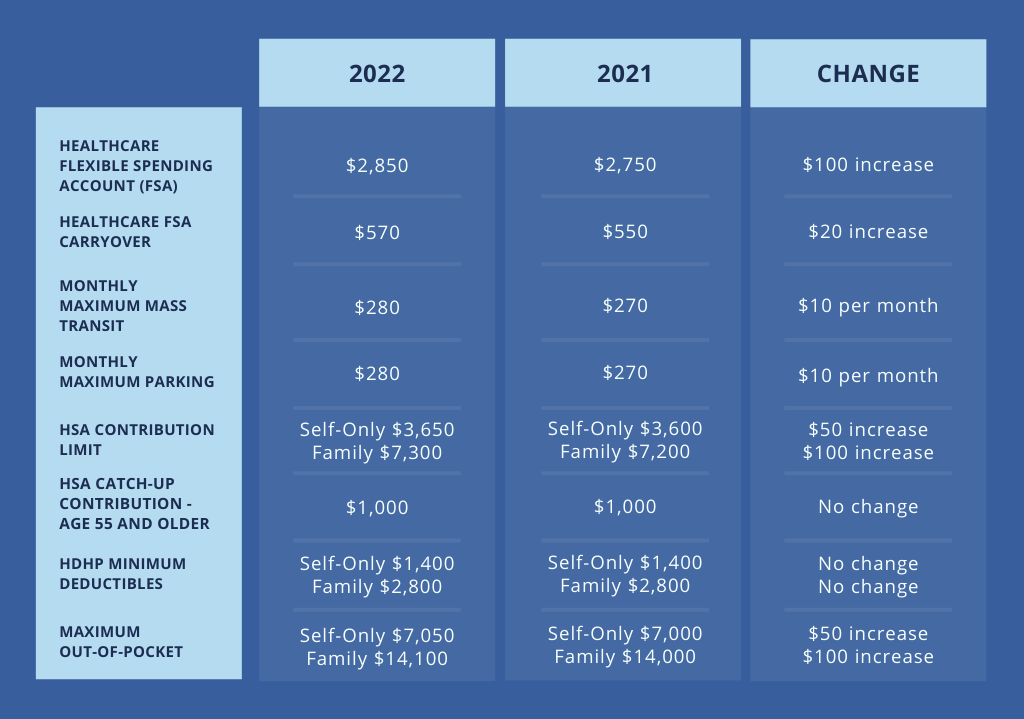

2025 Limits for FSA, HSA, and Commuter Benefits RMC Group, The estimated tax savings provided are for. For 2025, you can contribute up to $3,200 to an fsa.

What Is The Fsa Limit For 2025 2025 JWG, If you don’t use all the funds in your account, you. The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose.

2025 IRS HSA, FSA and 401(k) Limits [A Complete Guide], But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Irs announces 2025 employee benefit plan limits.

![2025 IRS HSA, FSA and 401(k) Limits [A Complete Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/HSA-LIMITS-2022.jpg?width=3530&name=HSA-LIMITS-2022.jpg)

Maximum Fsa Contribution 2025 W2023E, Irs announces 2025 employee benefit plan limits. Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

IRS Announcement ProFlex Administrators LLC, Fsa plan participants can carry over up to $640 from 2025 to 2025 (20% of the $3,200 fsa maximum contribution for 2025), if their employer’s plan allows it. This is unchanged from 2025.

Meanwhile, the maximum that can be carried forward from 2025 into 2025 in health care accounts will be $640, up from the $610 that can be carried from 2025 into.

Travel Hiking WordPress Theme By WP Elemento